How to Register an APOB for Flipkart Seller Account?

In today’s rapidly evolving e-commerce landscape, registering an Additional Place of Business (APOB) is crucial for Flipkart sellers aiming to expand their operational footprint and comply with GST regulations. This article explores the essential steps and requirements for registering their APOB, ensuring seamless business operations and compliance with tax laws. In this article we are going to discuss on how to register an APOB for Flipkart seller account.

What Is the APOB?

An Additional Place of Business (APOB) refers to any premises other than the principal place of business where a registered business carries out its business activities. For Flipkart sellers, this typically includes warehouses, fulfilment centres, or additional offices for storing, packaging or dispatching goods. Registering an APOB under GST is mandatory for businesses to ensure compliance with tax regulations, particularly concerning invoicing and tax liabilities associated with transactions from these additional locations.

Explaining the APOB for Flipkart

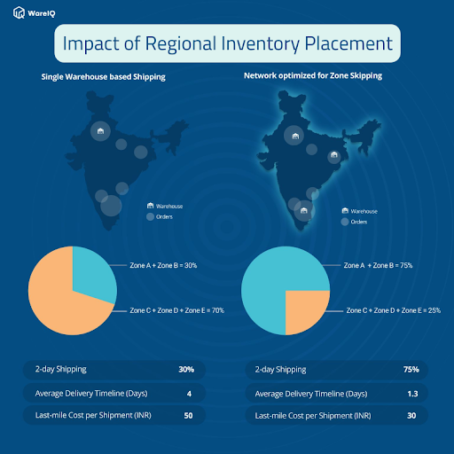

For Flipkart sellers, establishing an Additional Place of Business (APOB) is crucial for expanding operational capabilities and optimizing logistics. This involves strategically placing secondary locations such as warehouses or fulfilment centers to enhance product availability and delivery efficiency. Registering these APOBs under GST involves submitting necessary documentation to the GST portal, including proof of ownership or lease agreements. This registration ensures compliance with tax regulations and allows businesses to legally operate from multiple locations, facilitating smoother logistics and customer service.

How to Get a GSTIN Number for Flipkart?

Getting a GSTIN (Goods and Services Tax Identification Number) for your Flipkart seller account involves a systematic process to ensure compliance with tax laws:

- Registration Process: Start by visiting the GST portal (www.gst.gov.in) and selecting the option for new registration.

- Filling Application: Fill in the required details such as business name, PAN (Permanent Account Number), email address, and mobile number.

- Verification: After applying, you will receive an Application Reference Number (ARN) via email and SMS, which you can use to track the status of your application.

- Submission of Documents: Upload necessary documents, including proof of business address, the business entity’s PAN card, identity and address proofs of promoters/directors, and bank account details.

- Verification and Issuance: Once the documents are verified, GSTIN is issued, and you can download the GST certificate from the portal.

- Integration with Flipkart: Log in to your Flipkart seller account and navigate to the GST registration section. Enter your GSTIN and upload the GST certificate for Flipkart to verify.

Also read: Step-by-Step Guide to Registering an APOB for Amazon

How to Add GST on Flipkart?

Adding GST to your Flipkart seller account is crucial for compliance and smooth business operations. Here’s a step-by-step guide on how to do it:

- Login to Flipkart Seller Dashboard: Begin by logging into your Flipkart Seller account using your credentials.

- Navigate to Settings: Once logged in, navigate to the settings or account information section of your seller dashboard.

- Find GST Settings: Look for the option related to GST settings or tax details. This is typically under a section like “Tax Information” or “GST Registration”.

- Enter GSTIN: Enter the GSTIN (Goods and Services Tax Identification Number) you obtained from the GST portal during registration.

- Upload GST Certificate: Upload the GST certificate you downloaded from the GST portal after successful registration.

- Verification Process: Flipkart will verify the GST details you provided. This verification ensures that your GSTIN and certificate match the details on record.

- Confirmation: Flipkart will confirm the GST addition to your seller account once verified.

Benefits of Adding GST on Flipkart?

Adding GST to your Flipkart seller account offers several benefits:

- Compliance: Ensures compliance with GST laws, avoiding penalties and legal issues.

- Input Tax Credit (ITC): This enables you to claim ITC on taxes paid on inputs, reducing overall tax liability.

- Customer Trust: Builds trust with customers who prefer buying from GST-registered sellers.

- Business Expansion: Facilitates selling on Flipkart without hindrances related to tax compliance.

Why GST is Needed for APOB on Flipkart?

GST (Goods and Services Tax) registration is essential for APOB (Additional Place of Business) registration on Flipkart due to several reasons:

- Legal Requirement: Under GST laws in India, any business operating multiple places of business, including e-commerce sellers on platforms like Flipkart, must register each additional place of business under GST.

- Input Tax Credit (ITC): GST registration allows sellers to claim Input Tax Credit on taxes paid for purchases in business activities, reducing the overall tax burden. Sellers cannot avail of this benefit without GST registration, affecting their competitiveness.

- Customer Trust and Compliance: GST registration builds customer trust and signifies compliance with tax laws. It also ensures transaction transparency, reassuring customers about the seller’s legitimacy.

- Platform Requirements: E-commerce platforms like Flipkart require sellers to furnish GSTIN (GST Identification Number) details to ensure compliance with tax laws. This information is crucial for platform operations and legal compliance.

- Penalties and Legal Issues: Non-compliance with GST registration requirements can lead to penalties and legal consequences, impacting the seller’s reputation and business operations on Flipkart.

Understanding the importance of GST registration for APOB on Flipkart is crucial for e-commerce sellers to operate legally and efficiently. By ensuring compliance with GST laws, sellers avoid legal repercussions and enhance their business credibility and operational efficiency on e-commerce platforms.

Conclusion

In conclusion, registering an APOB for Flipkart seller account involves navigating the complexities of GST registration, which is essential for compliance and operational efficiency. By understanding the process of APOB registration and the significance of GSTIN for e-commerce operations, sellers can streamline their business processes and ensure legal adherence to Flipkart.

Sellers must follow Flipkart’s step-by-step guidelines and ensure all necessary documents are in place to facilitate smooth registration. By doing so, sellers not only comply with regulatory requirements but also enhance their business credibility and trustworthiness in the e-commerce marketplace.

You may also kike to read: APOB Vs PPOB: Differences and Their Impact on Your Amazon and Flipkart Store

FAQs About APOB for Flipkart

What documents are required for GST registration on Flipkart?

To register for GST on Flipkart, sellers typically need documents such as a PAN card, Aadhaar card, proof of business registration, address proof of business premises, bank account statements, and authorisation form.

How can I update my GST details on Flipkart?

To update GST details on Flipkart, sellers can navigate to their seller dashboard, locate the GST registration section, and follow the prompts to input or update their GSTIN details

Is GST registration mandatory for selling on Flipkart?

Yes, GST registration is mandatory for sellers on Flipkart if their turnover exceeds the prescribed threshold limits as per GST regulations.

What are the benefits of GST registration for e-commerce sellers?

GST registration enables e-commerce sellers to claim Input Tax Credit (ITC), comply with legal requirements, enhance business credibility, and participate in interstate commerce without restrictions.

How does APOB registration differ from VPOB on Flipkart?

APOB (Additional Place of Business) refers to additional physical locations where business activities are conducted and require separate GST registration. VPOB (Virtual Place of Business), on the other hand, pertains to virtual addresses used for business purposes.